Obtain your IRS tax records (transcripts)

What are irs transcripts?

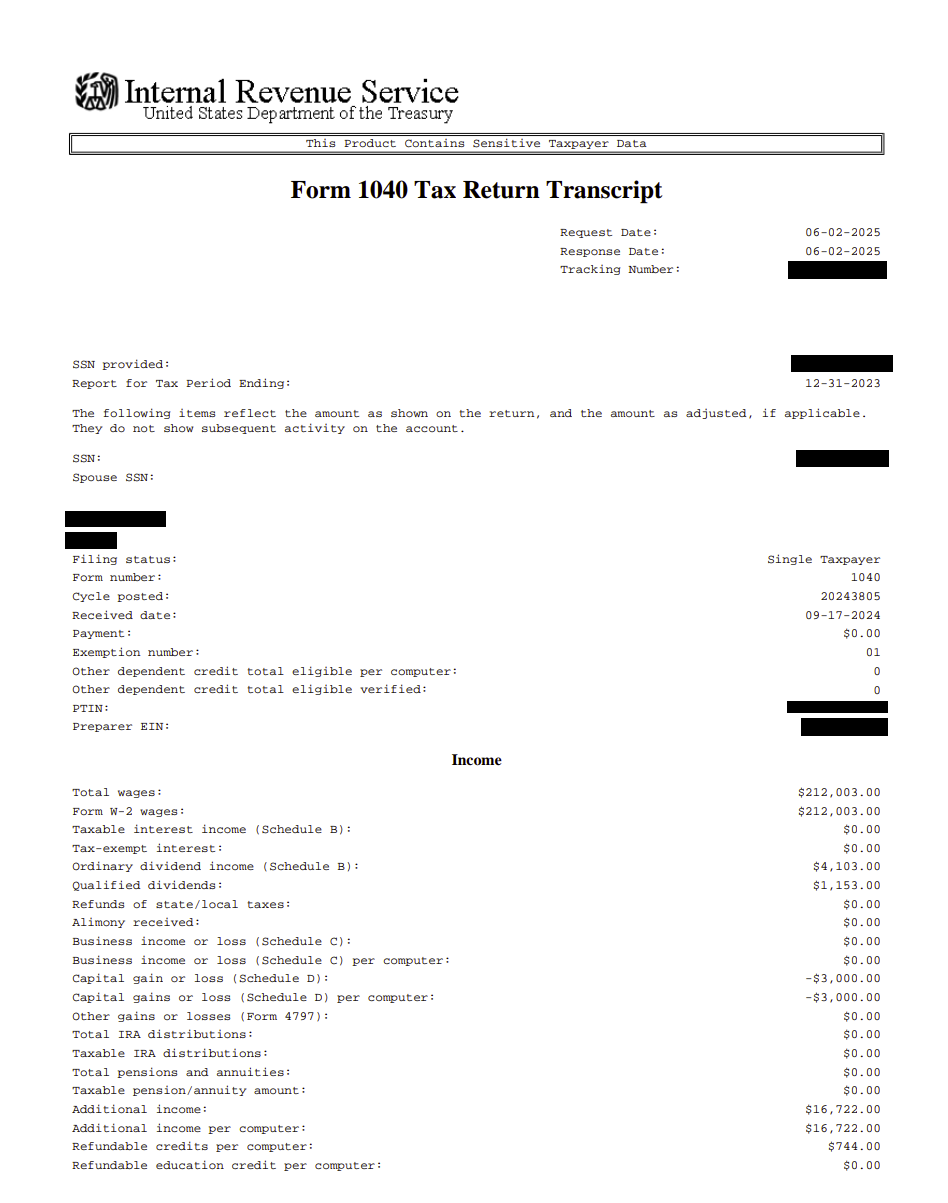

An IRS transcript is a summary of important tax-related information, depending on the type of transcript requested. It may include data from your filed return, income reported to the IRS by third parties (such as employers or financial institutions), and any changes or adjustments made after filing. IRS transcripts are valuable tools for verifying income, identifying discrepancies, monitoring account activity, and tracking the status of your tax filings.

Different types of IRS Transcripts:

IRS transcripts are commonly used to verify past income and tax filing status—especially for mortgage applications, student loans, and small business financing. They also assist with tax preparation and resolving issues with the IRS. However, it’s important to note that transcripts do not provide information about the status or timing of your tax refund.

Tax Return Transcripts and Record of Account Transcripts are only available for the current tax year and the three prior years.

Tax Return Transcript

A Tax Return Transcript shows most line items from your original tax return, including any accompanying forms and schedules, exactly as filed. However, it does not include any changes or corrections made after the return was submitted

Tax Account Transcript

A Tax Account Transcript reflects any adjustments or changes made to your tax return after it was filed—whether by you or the IRS. It also includes key details such as the type of return filed, your filing status, adjusted gross income (AGI), taxable income, and your payment history.

Wage and income transcript

A Wage and Income Transcript shows data from income forms such as W-2s and 1099s in addition to IRA Contribution and distribution information that was reported to the IRS. This transcript is often used to ensure that no information would be missed on a tax return especially to prepare a prior year's tax return.

Record of Account Transcript

A Record of Account Transcript provides a comprehensive view of your tax return by combining the information from both the Tax Return Transcript and the Tax Account Transcript into a single document.

How to Obtain Your IRS Transcripts

You can use the IRS “Get Transcript” Service and order your individual tax transcripts online or request them by mail. However, if you are confused about the years and the type of transcripts you need, you need business tax transcripts such as 940 and 941 transcripts, or you are not able to use the IRS website, you are not alone. We can help you obtain a complete record of your tax account by filing an IRS Form 8821 (Tax Information Authorization) with the IRS. We can also advise you of the necessary actions you must take and how to use these transcripts to resolve your tax problems, if any. Call us today!